Blog

COVID-19: Trademark Trends and the Health Crisis

- Trademark Solutions

By Stephen Stolfi – Chief Commercial Officer, Corsearch

In his recent articles here on corsearch.com, our President of Brand Protection, Daniel Bennett, outlined his predictions for how the COVID-19 crisis will reshape counterfeiting and online brand protection. There is, however, a second set of questions around the impact on brand establishment practices too.

As ever, Corsearch is here as your partner, not just a vendor. Please contact us if you have thoughts you’d like to share on these ideas, or on what more we can do to support you through this challenging time.

The Importance of COVID-19 for Brands and Trademark Applicants

It is no exaggeration to say that the COVID-19 crisis represents one of the biggest global economic challenges of our time. A noted professor of economics and former advisor to the White House and U.S. Treasury has compared the pandemic to the Great Depression and the 2008 financial crisis, but noted that what took months and years to evolve in those historical events, has happened in just weeks in 2020.[i] Thousands of businesses have either already gone bankrupt or are facing financial hardship.

One might expect that reduced budgets would mean an immediate pull-back, and that trademark establishment and marketing activity would come to a halt as brands and entrepreneurs put on hold trademark fillings until the COVID-19 crisis ends. Does the data from PTOs support this?

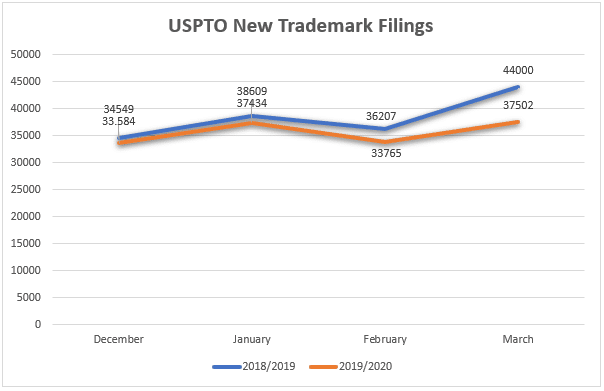

The United States Landscape

Even in advance of the COVID-19 crisis, activity at the USPTO reflected a decreasing trend for new trademark applications. In line with more global trends though, March 2019 vs. March 2020 did see a bigger divergence than usual (-15%). The question for coming months will be how long the crisis impacts our global economy as we head into a recession, and, when the crisis ends, whether there will be a sharp rebound or a slow, steady recovery.

The United States Sectoral Analysis

While the story in the United States is one of overall decline (26 of the 45 Class headings showed ≥10% fewer filings year on year), a few sectors are acting in ways that make interesting reading.

Chief among these is the pharmaceutical industry, which, despite rapid development is not yet filing new marks in great numbers. The activity around new marks filed in Class 5 between December and March was -14.1% on the previous year. It is possible that despite the activity, the field’s long regulatory processes are still governing activity, but with all of the activity around COVID-19 vaccines and treatments, as well as other activity in this sector, the fillings numbers will likely be increasing in the upcoming months.

Predictably, the companies filing fewest new trademarks are those hit heaviest by the burden of the lockdown. Clothing (Class 25 was -4.8%), restaurants & hotels (Class 43 was -10.8%), jewelry (Class 14 was -10.6%), and leather goods & luggage (Class 18 was -16.4%) have all showed steep declines.

In fact, of all the Class headings in the U.S., only two showed positive year-on-year performance between December and March: firearms (Class 13 was +11.5%) and industrial lubricants and candles (Class 4 was +4.2%), but as both of these niche fields have relatively few new filings, their growth may not signal a great trend. What is sure to be even more interesting is how these same sectors track through April and early Summer.

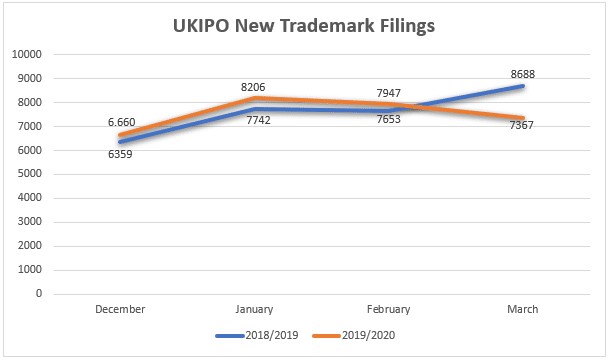

The United Kingdom Landscape

According to the number of new trademarks filed at the UKIPO, the start of 2020 saw the continuation of a broad trend for increased activity on the previous year. The monthly increase on the figures from December to February (approximately 5%) was likely the continuing impact of Brexit, resulting in broad swathes of new applications. However, as the situation with COVID-19 became more widely reported in the UK and across Europe, there was a marked drop in activity (-15% on March 2019).

U.K. Sectoral Analysis

New filings in the U.K. showed some similarity with the United States when it comes to the decline of certain sectors, including electronics (Class 9 was -7.2%) and hotels & restaurants, which also decreased (Class 43 was -10.1%). This is unsurprising, but what may be interesting is how hospitality businesses in particular decide to pivot towards other activities while their outlets are closed. There have been some examples of restaurants deciding to open retail and delivery stores, for example. If this continues then we might expect that Class 35 may see an increase in new filings. On the recent data, Class 35 is tracking at -2.7% year on year.

In terms of positive fortunes, there were some domestic-related increases in the U.K. around Class 24 for home soft furnishings & linens (+8.5%), and industrial lubricants/candles (+27.4%). Whether this was a result of an anticipation that more people would be spending time in their homes will become clearer in the coming months. Another rise in the U.K. came from new marks filed in Class 26 for dressmaking/craft accessories and materials (15.3%). It is possible that this may be related to the boom in self-directed hobbies, and it will be interesting to see if a similar increase emerges for Class 28 given the well-publicized growth in consumer interest in toys and games.

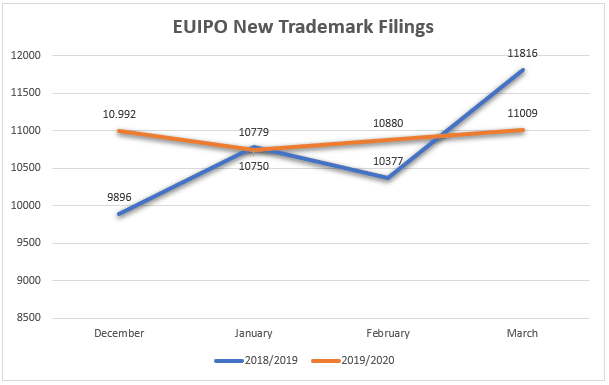

The European Union

The relative decline in activity at the EUIPO during March 2020 appears to have resulted from a spike in the previous year more than from a specific contraction against COVID-19. Although there was a decline on 2019 filings (-7%), it was against a backdrop of a 14% rise from February 2019 to March 2019. What does this suggest? Perhaps that the mood among European businesses was less troubled than in the U.K. or U.S., or perhaps that the wide range of jurisdictions included within the EUIPO encouraged a continued and diverse pipeline.

EU Sectoral Analysis

New EU marks filed in Class 5 for pharmaceuticals bucked the U.S. trend by demonstrating a growth of 10.1% on the previous year. It is too early to say whether this is related to the coronavirus pandemic, however, and the sector’s performance through early Summer will be more indicative. Even though conclusions at this stage must be tentative, what is interesting is that filings in Class 10, which includes medical devices such as masks and gloves, rose by 24% and chemical filings in Class 1 also rose by 13.8%. Whether it is related or not, the sector still seemed more buoyant in Europe through the beginning of the pandemic.

Performing less well were some of the same industries that have taken hits in the other jurisdictions noted. Leather goods, handbags & luggage fell by -11.3% (Class 18), as did tobacco and smoking accessories (Class 34 was -27%). On the whole, however, new marks filed at the EUIPO appeared stronger during the 1st quarter of 2020 than in the other regions.

Future Directions for New IP Generation

Despite the obvious seriousness of the COVID-19 crisis, not all businesses are facing a downturn. Looking across different industries, there are some reports of companies thriving and re-purposing resources, all of which requires new filings and a whole new set of IPRs. The gravity of the pandemic has already challenged many businesses to examine their goals and purposes, and in some instances, this has led to the creation of new products and services, or the diversification of existing enterprises.

One example of this can be seen in one of the most in-demand products of the emergency, hand sanitizers. Here in the U.S., alcoholic beverage manufacturers including Anheuser-Busch have begun using their raw materials and distilleries to produce hand sanitizers. Globally, Pernod Ricard has also been engaged in distributing pure alcohol, manufacturing hand sanitizers, and providing support. It’s not just alcohol businesses either. In France, LVMH’s perfume business was re-tooled within just 72 hours to start creating hand sanitizers destined for use by French health services.[i]

Some companies have taken up the challenge and even produced accompanying design and marketing. In the United Kingdom, the Scottish brewery, Brewdog, has already designed and started producing Brewgel Punk Sanitiser, for the benefit of at-risk groups and other organizations. There are many such examples of brands pivoting to new products and services, including restaurants now producing takeaway ready meals,[ii] and luxury brands such as Burberry creating masks and gowns.[iii]

This widening of product ranges into previously uncharted territories may just be one of the ways which trademark practitioners experience the fall-out of the crisis. No one knows yet exactly how these temporary trends will affect changes in working processes, but it pays to be alert to what is occurring in filing practices geographically, and within different international Classes.

In addition to new products and directions, perhaps the most obvious impact is the demand for eCommerce when consumers can no longer reach physical stores. As he noted in his article, Daniel Bennett observed that data from the U.S. Census Bureau for January and February 2020 indicates continued year-on-year growth for non-store retailers. My belief is that this may even lead to the emergence of a flood of new eCommerce businesses to satisfy increased consumer demand. If so, this would have a significant impact on new filings.

While it is not yet clear exactly how the COVID-19 crisis will change the way we establish, clear, and protect trademarks, it appears there could be changes as workflow and new ways of working evolve, and as different regions, Classes, and industries come to the forefront. I hope that when the new landscape does emerge, your business and health is strong, positive, and flourishes. We, at Corsearch, will be here, as always, to continue to support your evolving needs.

*This is an informational opinion article by Stephen Stolfi of Corsearch. The views and opinions expressed in this report are those of the author and do not necessarily represent official policy or position of Corsearch or its clients.

***

[ii] https://www.ft.com/content/e9c2bae4-6909-11ea-800d-da70cff6e4d3

[iii] https://www.stylus.com/fastfood-restaurants-become-mini-supermarkets